Detailed posts on Next Big What and Your Story.

Future of Startup Accelerators and Entrepreneur Support Organisations - 2015 India in Focus12/2/2015 Over the last two years, there has been a proliferation of accelerators around the world and entrepreneurs have differing takes on why they did or didn’t join them. Accelerators like Y Combinator and Techstars figured out in 2005 and 2006 that providing seed money, advice, and connections over a condensed period of time can help businesses grow. They helped pave the way for all the startup accelerators we see today.

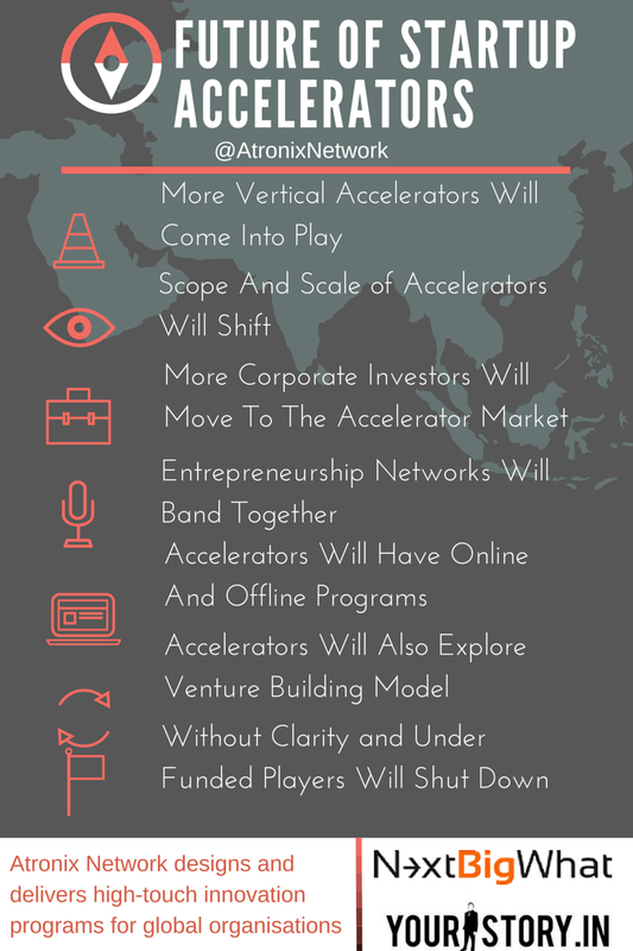

In India, Microsoft Ventures, Tlabs, GSF, The Startup Centre and Kyron among other startup accelerators are becoming increasingly popular and have demonstrated the need for these support systems to exist. Based on my experience and research over the last three years, majority of the accelerators are experimenting various models around the world and we'll see some big changes in the coming months. 1. MORE VERTICAL ACCELERATORS WILL COME INTO PLAY Accelerators like GSF rolled out a new vertical in the digital media space and launched Mobile Accelerator 2 months ago. Surge has focused only on companies in the energy industry, which has led to exponentially greater results (both for the startups and for the accelerator itself). Expect to see more accelerators focusing on select vertical markets (e.g., medical, food and beverage, and advertising). 2. SCOPE AND SCALE WILL SHIFT Currently, 95 percent of accelerators focus on early-stage companies only. Due to the verticalization of accelerators, there will also be a change in scope and scale of accelerators. In 2014, Private and corporate investors have invested $47 billion across 3,617 companies and 300+ Indian startups have received over $5 billion. Expect to see programs opening up to later stage companies (e.g., Seed Series A, etc.) 3. MORE CORPORATE INVESTORS WILL MOVE TO THE ACCELERATOR MARKET As there will be specialisation in private accelerators, there will be more corporate backers. These backers will get the first look and have an investment priority with the new startups. Microsoft, Target, Coca Cola, Paypal, Pitney Bowes, Citrix and Reliance have recently set up their own startup accelerators to take advantage of India's tech potential. BMW, Kaplan, Disney, Pearson, DP World, Volkswagen, Barclays, Samsung and many others are actively running accelerator programs around the world. 4. ENTREPRENEURSHIP NETWORKS WILL BAND TOGETHER Few interesting things that I have noticed over the last couple of weeks in India is that corporates are leveraging non-profit entrepreneurship networks such as Nasscom, TiE and NEN to engage with startups in India. Investment networks and entrepreneur support organisations are also co-creating events. Tech star's initiative - Global Accelerator Network has already built a network of 50 accelerators to share resources and know-how to help each other succeed. There are co-working spaces, business contests and startup conferences which also support founders in their own ways and can collaborate as well. 5. SOME ACCELERATORS WILL EXPLORE VENTURE BUILDING MODEL Venture building model is where the organisation will build companies using their own ideas and resources. New teams can be formed for validated business ideas internally or from corporates, governments and universities. Frictionless Ventures and Seedstars in Switzerland are great examples for venture building organisations. 6. ACCELERATORS WILL HAVE ONLINE AND OFFLINE PROGRAMS To capture new markets, offer high touch programs and improve the quality of deal flow, accelerators will expand their reach into other regions and launch virtual programs to tap into this explosion of innovation. Toronto-based Ryerson Futures Inc. has launched ‘Zone Startups’, in a joint venture with the Bombay Stock Exchange Institute in Mumbai. Multi-city GSF Accelerator has kicked off their 13 week global accelerator program ,Tlabs started their accelerator in Bangalore last month and they showcase demo days online. 7. ACCELERATORS WITHOUT CLARITY AND UNDER FUNDED PLAYERS WILL SHUT DOWN There will be tremendous pressure for new and small accelerators to attract quality deal flow with increased competition as the market becomes saturated. Startups have many options to choose and under funded players will gradually die. Turner, a broadcast network shut down its media camp accelerator after working with 27 startups during its 3 years operation. Its founder Balaji mentioned "We have not found the clarity and direction that we needed to continue". Hatch in India has shut operations and India's oldest accelerator (Morpheus) is not operational as well though founders have stated that they are working on evolving the model. Last year, two Bangalore based startups made news as they exited after being a part of an accelerator program. Little Eye Labs was accelerated at GSF Accelerator and got acquired by Facebook whereas Bookpad from Microsoft Accelerator was acquired by Yahoo . It will be interesting to see how accelerator models will evolve to improve the chances of success for their portfolio ventures. Feel free to share your thoughts on accelerator model changes in the coming years in India and globally. Arjuman Amjad is a cofounder of Atronix Network, a Bangalore based innovation management consultancy that designs and executes innovators program for intrapreneurs and entrepreneurs. Global Corporations are often looking at innovative technologies to address the ever increasing customer demands, competition and growing needs and Indian startups are building disruptive technologies for various global markets. Indian Entrepreneurs are also looking at partnering with the best organisations to take their business to the next level.

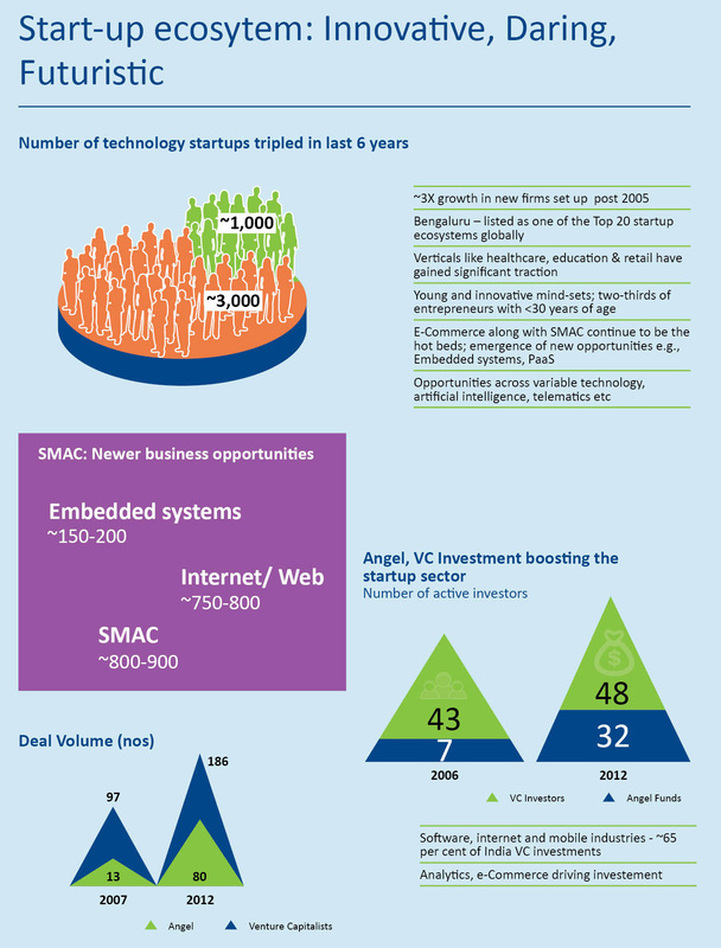

We have listed some of the best corporates who have made news in the Indian Startup Ecosystem during the last few weeks. Here it goes... INFOSYS - Aug 1st 2014 Vishal Sikka - CEO, Infosys: "We have a $100 million fund that our shareholders and board had approved. I want to utilise it starting today. We want to work to be a great amplifier for start ups here in India and also in other parts of the world, in the (Silicon) Valley, US and to focus on improving not only learnability and learning, but also our abilities" WIPRO - 28th July 2014 Wipro to invest up to Rs 600 crore in startups. Wipro founder Azim Premji's PremjInvest, have made recent investments in e-commerce firms like Myntra and Snapdeal. GENERAL ELECTRIC - 2nd July 2014 Last week, GE Healthcare announced that it will open its John F Welch Technology Center in Bangalore for startups with ideas for frugal innovation in the maternity and infant healthcare space, where the number of deaths in India have been high. CISCO - 23rd June 2014 Cisco Investments has set aside $40 million (Rs 240.9 crore) to invest in early stage Indian startups focused primarily on three verticals--connected mobility, big data and internet of things over the next 18 months. As part of the $250 million (Rs 1,503 crore) global fund, Cisco has invested in two Indian companies - Mumbai-based Covacsis, a realtime analytics platform for industries, and Bangalore-based Mob-Stac, a mobile app developer. AMAZON - 25th May 2014 The Seattle-based internet giant is working with its India unit to scout for startups, which could be of strategic interest. Since 2005, Amazon has been largely investing in startups in the US. QUALCOMM - 25th May 2014 Qualcomm Ventures awards four Indian startups a total of $250,000 (Rs 1.4 crore) in funding from a clutch of investors and corporates at Qualcomm's annual QPrize challenge. Globally, some of the biggest technology names such as Intel, Cisco and Dell have dedicated corporate ventures for investing in startups and mature ideas that are disruptive. It is terrific to see corporates engaging with startups actively, especially in India. If you belong to the startup community or a corporate group - do share your thoughts in the comments section below. Quick Sign Up to receive our Exclusive Innovation Case Studies. This 5 minute video by Peter Diamondis and DrawShop explains exponential technologies in the coming years. The next quarter century promises to be a wild ride! Check out the video to get inspired and prepared to work on the next big thing! Now.... #Singularity #PeterDiamondis

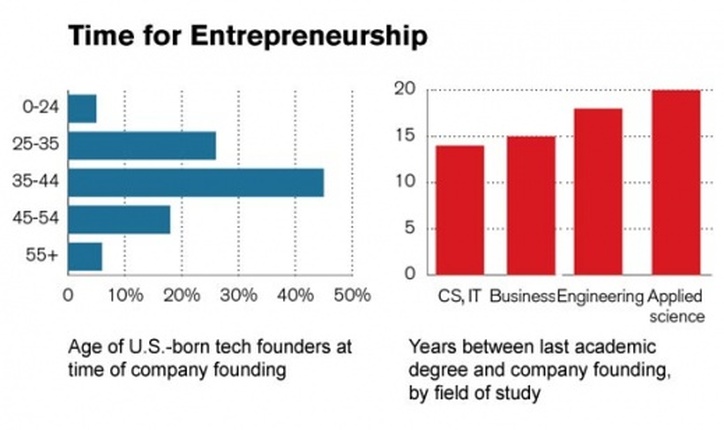

Venture capitalists in Silicon Valley prefer to fund the young, the next Mark Zuckerberg. Why? The common mantra is that if you are over 35, you are too old to innovate.

To a degree, the cult Silicon Valley has built around young people makes sense—particularly in the Internet and mobile technology. The young have a huge advantage because they aren’t encumbered by the past. Older technology workers are experts in building and maintaining systems in old computer languages and architectures. They make much bigger salaries. Why should employers pay $150,000 for a worker with 20 years of irrelevant experience when they can hire a fresh college graduate for $60,000? After all, the graduate will bring in new ideas and doesn’t have to go home early to a family. A key ingredient in innovation is the ability to challenge authority and break rules, a passion the Internet is unlocking among a new generation of youth worldwide. The young understand the limits of the Web world, but they don’t know their own limits. It’s proving to be a powerful combination. Since they don’t know what isn’t possible, the Zuckerbergs can come up with new solutions to old problems. That is why they lead the charge in starting innovative mobile and Web companies. When you meet entrepreneurs in India, Ireland, Brazil, and other parts of the world, you find many of the same dynamics at play. The young have the outrageous ideas, but its older people who achieve business success. In all these countries, youth entrepreneurship is on the rise. But understanding diverse technologies isn’t the domain of the young. Though college dropouts may know all about social media, it is very unlikely that they understand the intricacies of nanotechnology and artificial intelligence as well as their elders do. These are complex technologies that require not only a strong education but also the ability to work across domains and collaborate with intellectual peers in different disciplines of science and engineering. The reality is that there is no age requirement for innovation. The young and old can both innovate. The young dominate new-era software development, and software will be a key driving force in the convergence of other technologies that are expanding exponentially. So we badly need our young. And we need our older entrepreneurs to develop cross-disciplinary solutions that solve the grand challenges of humanity. #TechReview #MIT #VivekWadhwa #InnovationResearch tata group: taking the agenda of innovation ahead and providing risk capital to new ventures13/6/2014  The Tata Group is planning to come up with a formal structure at the group level to foster innovation across all its companies, a top Tata Sons executive said. Rajan said some group companies such as Tata Industries and Tata Capital have been taking the agenda of innovation ahead and providing risk capital to new ventures. "At present, the group together spends around 2.5% of total revenue on R&D which will go up in the days to come." Tata Sons has also created a team of chief technology officers across the group and it meets twice a year "to foster closer collaboration between group companies", he said. "All such efforts and initiatives will be intensified." #Economic Times #Corporate Innovation #TataGroup startups - why you have the opportunity of building the next billion dollar company in india?3/6/2014 #NasscomProductConclave #RajanAnandan #GoogleIndiaMD

|

Leave your email to get latest updates on Get Real. Experiment. Fast.

Atronix Network is a new age innovation partner for global organisations.

Categories

All

Archives

February 2015

|

RSS Feed

RSS Feed